IC Markets is a global forex broker based in Australia that was established in 2007.

A number of branches of the firm are located in other areas and are regulated by the Cyprus Securities and Exchange Commission (CySEC), the Seychelles Financial Supervisory Authority (FSA), and the Australian Securities and Investments Commission (ASIC).

IC Markets, Broker Regulations

Under the licence number 335692, the Australian Securities and Investments Commission (ASIC) granted the IC Markets brokerage its licence and began regulating the company in 2009.

As one of the most famous online trading brokers on the market, the brand has earned a reputation for being trustworthy. The Australian Securities and Investments Commission (ASIC) is a reliable and severe regulatory organisation that requires the platform to adhere to tight standards and processes.

Open IC Markets Account

In addition to being governed by the Australian Securities and Investments Commission, the brokerage is a member of the Financial Ombudsman Service (FOS). IC Markets’ Client Complaint Resolution Service enables them to settle any problems they may have in a timely and professional manner.

This provides traders with an additional layer of safety as well as increased client satisfaction since they know they will be covered if any concerns emerge in the future.

IC Markets additionally has two other regulated brands under which it does business:

- True ECN Trading Ltd owns and operates IC Markets (SC), which is regulated by the Financial Services Authority of the Seychelles.

- IC Markets (EU) is a trading platform for European traders that is governed by the CySec (and conforms to recent ESMA restrictions on leverage etc).

These brands provide traders with the flexibility to smoothly transition between them, letting them to select the amount of regulatory scrutiny and protection with which they are most comfortable.

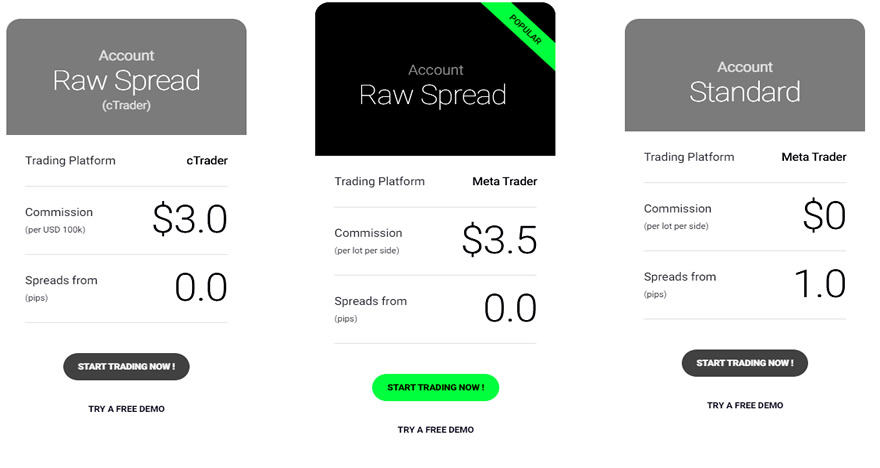

IC Markets Account types

IC Markets offers three major accounts, each with its own set of trading circumstances. These accounts are designed to give traders with a dynamic trading experience as well as a clear pricing schedule, and they are available to new and existing clients.

Open IC Markets Account

IC Markets accounts include:

- MetaTrader Standard account

- cTrader Raw Spread account, and

- MetaTrader Raw Spread account.

IC Markets MetaTrader Standard Account

The following characteristics are included:

- A deposit of at least US Dollar 200 is required.

- Leverage up to 1:500 (up to 1:30 in Europe).

- Spreads from 1.0 pips.

- Commission-free trading.

- The possibility to trade in micro-lots as little as 0.01 lots is available.

- Access to 64 different Forex pairs as well as Index CFD trading is available.

- Remove the threshold of 50 percent from consideration.

- The ability to make advantage of one-click trading is available to you.

- There is also the option of opening an Islamic Account.

- All trading styles are permitted, and there is no restriction on order distance.

IC Markets cTrader

cTrader Raw Spread Account includes the following features:

- A deposit of at least US Dollar 200 is required.

- Leverage up to 1:500 (up to 1:30 in Europe).

- Spreads starting at 0.0 pips.

- Commissions of US Dollar 3.0 are levied each lot, while commissions of US Dollar 6 are charged per lot for round turns.

- The possibility to trade in micro-lots as little as 0.01 lots is available.

- Access to 64 different Forex pairs as well as Index CFD trading is available.

- Remove the threshold of 50 percent from consideration.

- The ability to make advantage of one-click trading is available to you.

- There is also the option of opening an Islamic Account.All trading styles are permitted, and there is no restriction on order distance.

Open IC Markets Account

IC Markets MetaTrader Raw Spread Account

MetaTrader Raw Spread Account includes the following features:

- A deposit of at least US Dollar 200 is required.

- Leverage up to 1:500 (up to 1:30 in Europe).

- Spreads starting at 0.0 pips.

- Commissions of US Dollar 3.5 are levied every lot, and commissions of US Dollar 7 are payable for each round turn.

- The possibility to trade in micro-lots as little as 0.01 lots is available.

- Access to 64 different Forex pairs as well as Index CFD trading is available.

- Remove the threshold of 50 percent from consideration.

- The ability to make advantage of one-click trading is available to you.

- There is also the option of opening an Islamic Account.

- All trading styles are permitted, and there is no restriction on order distance.

IC Markets Demo Account

IC Markets offers traders the option of opening a Demo Account which can be utilized in various ways, including, but not limited to the following:

- Practice accounts are available for new traders who want to enhance their trading abilities and experience in a risk-free environment by trading with virtual funds.

- Traders who are assessing and comparing brokers and who would want to study IC Markets’ trading conditions in a risk-free environment, as well as traders who are analysing and comparing brokers

- Traders who want to test their trading methods in a live trading environment that is similar to the real thing without endangering their funds.

- Signing up for a sample account at IC Markets is completely digital and hassle-free. When completing the registration process, demo trading can begin immediately after the trader has downloaded and installed the appropriate trading platforms on one of the following devices:

- Desktop computers that run Linux, Windows, or macOS, as well as laptop computers

- Those mobile devices, such as tablets and smartphones, that are powered by the Android or iOS operating systems

- Alternately, traders may quickly and simply access the trading platforms via their web browser and use their credentials to login into their IC Markets Demo Account using the WebTrader provided by the trading platforms.

Open IC Markets Account

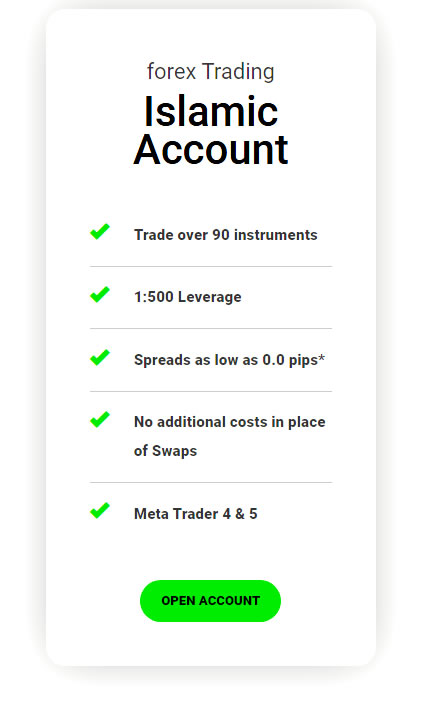

IC Markets Islamic Account

The goal of an Islamic Account is to provide a specialised service to Muslim traders who adhere completely to Sharia law in their transactions. Interest, such as overnight costs, that are considered wasteful or exploitative by the law are prohibited from being paid by those who adhere to it.

Overnight costs are levied to traders who keep positions open for a longer period of time after the trading day has ended, and this sort of account allows traders to avoid paying such fees or interest if they keep positions open for a longer period of time.

With the option of an Islamic Account on all live trading accounts provided by IC Markets, Muslim traders benefit from the fact that they will not be charged any additional commissions or admin fees, and spreads will not be increased to compensate for the lack of overnight costs.

Muslim traders, on the other hand, should be aware that, despite the absence of additional costs, they will still be subject to the trading conditions of the account type into which they register, which will thereafter be converted to those of an Islamic Account.

In order to make a request to have their live trading account converted into an Islamic Account, Muslim traders will first need to complete the registration process for a live trading account, as well as the financing of that account.

The variety of account types available guarantees that traders have access to a trading environment that is competitive and cost-effective in terms of both trading and non-trading expenses.

IC Markets traders are provided with the competitive advantage they require to facilitate their trading activity, regardless of their degree of skills, expertise, or experience in the financial markets.

IC Markets Trading fees

For more information about Spreads and Swaps click here: IC MARKETS SPREADS

Trading costs at IC Markets are competitively priced.

It is quite difficult to compare trading fees amongst forex brokers. What exactly did we do at BrokerChooser? Instead than quoting lengthy charge tables, they evaluate brokers by computing all of the costs associated with a hypothetical deal involving two different currency pairings.

In this context, the example would suggest that you purchase something for $20,000 with 30:1 leverage and then sell it after a week.

There are no restrictions on who may use this benchmark because it covers spreads and financing charges from all brokerages.

Account opening

Open IC Markets Account

An account with an online broker is quite similar to a traditional bank account, and the process of creating one is at least partially completed online. Some brokers process your application as quickly as starting a new Gmail account, while others require you to wait a couple of days while they do a background check on you. The money in your account will be used to hold your financial assets, such as stocks or foreign exchange holdings, as opposed to merely your money. A new account can be opened at any time without fee.

This provider’s disclosure statement states that 73.59 percent of retail investor accounts lose money while trading CFDs with them. You should think about whether you can afford to incur the significant risk of losing your money in this situation.

IC Markets offers a number of additional advantages that should be taken into consideration when opening an account.

Deposit and withdrawal methods

The IC Markets trading broker requires a $ 200 minimum deposit to begin trading. New traders in the IC market will be able to utilise the AUD, USD, EUR, GBP, SGD, NZD, JPY, HKD, CHF, and CAD as the base currency. Other currencies such as the CAD, HKD, and EUR will also be available. With a normal or raw spread account, you can use many messages in the IC Market to make a minimum deposit in order to meet the requirements.

Customers are attracted to the cheap minimum deposit and their interest in trading grows as a result. IC Markets is a well-known forex and contract for difference (CFD) broker. As a result, each new consumer must register an account in order to be trusted and assured. The minimum deposit facility is offered on the IC Market just as a condition; the minimum deposit facility is provided to boost the attention of clients towards the trader and to provide chances for traders.

For deposits, you can use any credit/debit card, Neteller, Skrill, Clarna, or a cable transfer to fill your account, or you can use a combination of these methods. Because it provides the most competitive offers to clients or traders, IC Markets is a market that is quite famous among forest bloggers.

There will come a point when, whether you are using an online broker for short-term trading or for longer-term investments, when you will want to reap the benefits of your trading activity if you have been successful in your transactions, or you will simply require access to your funds for any reason. It is necessary to first remove funds from your broker account in order to do this.

That doesn’t sound very complicated, but brokers differ considerably in what withdrawal options they offer (such as bank transfer or credit/debit cards), as well as in the speed and convenience of withdrawal. Furthermore, while withdrawals at many brokers are generally free, some brokers and certain types of withdrawals may be subject to a charge under certain circumstances.

Trading platforms

Because it provides both the MetaTrader and the cTrader platforms, as well as quick execution (no requotes) and order placement inside the spread, IC Markets has reinforced its position as a leading choice for algorithmic traders.

The bottom line is that IC Markets is our top-rated MetaTrader broker for the year 2022.

Trading systems from MetaQuotes Software Corp., such as MetaTrader 4 and MetaTrader 5, as well as the cTrader platform from Spotware Systems, are all available through IC Markets. There are also plugins from AutoChartist and Trading Central that are accessible to MetaTrader clients. The potential for these third-party plugins to enhance the MetaTrader experience makes the extra effort required to install and maintain them worthwhile.

With a broad collection of pre-installed and third-party indicators, both MetaTrader and cTrader offer excellent charting capabilities. The IC Markets cTrader platform is accessible both online and offline, depending on your preference.

Trading Tools for MetaTrader: Advanced Trading Tools, a set of platform add-ons developed by FX Blue LLP, is available through IC Markets. Trading Central and AutoChartist third-party plugins are also available from IC Markets.

Open IC Markets Account

Markets and products

You can trade on many Markets and Products with IC Markets: Forex, Commodities, Indices, Bonds, Digital currencies, Stocks, Futures

Even though IC Markets does not give any bonuses or promotions, I believe that the trading atmosphere is preferable than any incentives. It is seen as a bonus that does not necessitate the use of extra incentives in order to attract new customers.

Customer service

Customers can reach out to traders at any time of day or night. I recommend starting with the Help Center, since it has a wealth of information. Although the live chat tool provides quick access to a professional, I prefer calling for more urgent questions. There is also the option of requesting a callback.

You can also contact IC Markets via a support Ticket system, support agents generally reply within few minutes or hours.

IC Markets does not identify other languages are available in addition to English, but it does a good job of explaining its products and services.

Open IC Markets Account

Education

The IC Markets blog is a source of high-quality analysis and trading ideas for investors and traders and includes:

- Lessons on Trading Knowledge, Advantages of Forex, Advantages of CFDs

- Video Tutorials

- Web TV

- Webinar

- Podcast

- Week Ahead

- Getting Started (10 Lessons)

I particularly recommend the Fundamental Analysis and the Technical Analysis sections, both of which are fantastic readings. Trading Central’s WebTV service offers value to the research area of IC Markets’s website.

Markets International Corporation (IC Markets) provides an excellent instructional platform for beginning traders.

For novice traders, I recommend that they start with the video tutorials and then go on to the 10-lesson Getting Started trading course.

>> Visit IC Markets <<

Webinars are another wonderful service offered by IC Markets. They are hosted by seven professionals in five languages: English, Spanish, Chinese, Portuguese, and Thai. A younger generation of traders appreciates the significance of the podcasts, which are delivered by two presenters and continue to be highly popular with them.